I am re-posting this blog post to help me get into the saving groove for the New Year!

Written By: Karen du Toit

Brand: Budget Insurance

We are feeling the pinch even more this year!

I do not think it is only us, as I have heard many expressing the same misgivings about the exorbitant nature of this time of the year. We have to survive the festive season, but also be able to cope in the New Year which has its own demands.

- Hubby is still busy getting his business off the ground.

- The Student is going to do a post-graduate diploma next year, and we do not have the luxury of a bursary any more next year!

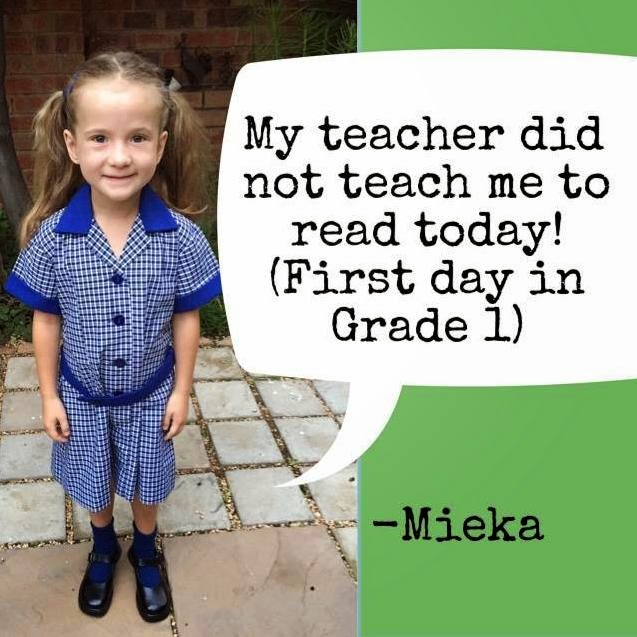

- Little Miss wants to start with music lessons on top of her other extra-murals.

- We are planning a trip to visit my brother in America in the middle of 2015! We have to start “saving”! My sister believes you just put down the date and make it happen. We have! (Take note, Universe!)

I have compiled a list of things we can do to save-a-bundle this period, but also try to help us get into the groove of the New Year and help us to stick to our New Year resolutions.

13 Save-a-Bundle tips:

1. Cancel the gym contract

I am very sad about this one, but each month we try our utmost to get to the gym regularly, but each night there is a different reason (excuse). We are weak!

But it is costing us mega bucks when we do not go enough!

We are also cancelling the swimming lessons for Little Miss. We wanted her to be able to swim, and that she can do by now. We carried on with it because she enjoyed it so much, but luckily we could also convince her that she is now going to swim in a cold water pool which is not going to be as pleasant any more. (It worked!)

From now on we will walk/run and make an effort to go to a park/swimming pool! I have also activated my Fitbit again. (I had to replace the battery.) It helps in getting me moving.

2. Cancel the paid television subscriptions, or scale down the bouquet

I do not have such an issue with this one, as I have been telling Hubby that I do not think it is worth it! We do not have the time to watch everything, but Hubby has always been saying that he still wants to watch that rugby match. (He longs for a time when he was single and could spend a whole weekend parked in front of the TV. Not happening!) It mostly never materialises because something usually happens at exactly the same time the rugby match is on.

3. Only go to the shops once a week

I have been good with this one already. It helps because when I go to the shops I usually see something that I did not know before the time that I “needed”.

4. Make our lunches at home

This is a no-brainer, but I tend to make Little Miss an elaborate lunch-box, but do not fix us something. Then we have to buy something at the canteen, or in the shops that is much more expensive. Planning here is the key!

5. Restaurants

Painful! But we have to scale down considerably! We have to keep it to once-a-month, and not once-a-week.

We also have to have a plan in place for when the load shedding kicks in (it seems it is happening more regularly). We must have something in the “cupboard” and fridge to take out. We have a gas braai (barbecue), and Hubby usually doesn’t need a reason to braai.

6. Activate all the reward systems possible

Banks and shops give rewards for shopping with them. One of my favourites is Dischem. We also get a R50 discount from Spur every so often. (Of course, from now, we are going to get it less!)

I also love the Edgars’ reward system.

I need to activate a couple of Spar cards, as well as activate my UCounts rewards.

Please let me know of other reward systems?

7. Insurance

Check all our short term insurance again.

Budget Insurance has

online insurance quotes with saving specials which are worth checking out!

8. Scale down on coffee

I don’t have to go and buy coffee, but make do with the Ricoffy in the office. I have become better at not going to the canteen for my coffee fix, but I need to stop this practice to save a considerable amount in a month!

9. Vacations/Stay-cations

Stay at the holiday destination (or home) and do not drive around as much. Explore all the opportunities in your immediate location. I will let you know how this one worked out. (*Crying!*)

10. Cleaning up my budget from supporting representatives from selling products from brochures

It is usually much more expensive as you pay a commission fee on each product as well. From now on I will go and buy in the shops. (Sorry!)

11. Free Christmas printables

I saw this on Kidspot, and will definitely do it this year!

The following is available:

- Christmas templates

- Christmas gift list printable

- Printable Christmas budget planner

- Printable Christmas food shopping list

- Printable Christmas tags

- Free printable Christmas tags

- Printable Christmas colouring in tags

- Printable Christmas swing tags

12. Limit the Christmas gifts budget

Only one toy/gift for the children, limited to a certain amount. The children don’t even question this. Hubby and I have also put a limit on our gifts to each other.

13. Sign up for free edX or MOOC courses

I want to continue with some studies, but while I am not able to afford post-graduate studies or completing that Masters, I can sign up for free courses to keep me in the loop in my career and professional development.

edX

MOOC

This is my list for now. I am making it a work in progress.

Please let me know of other good save-a-bundle ideas?

This is a sponsored post